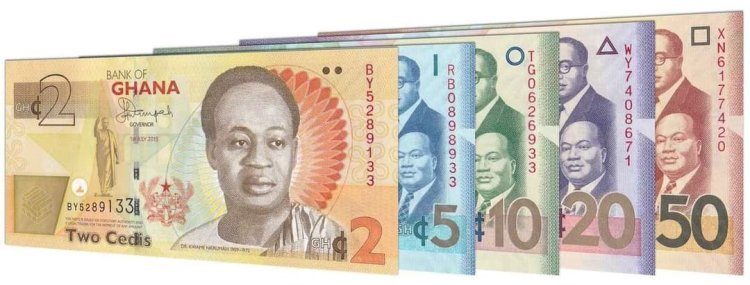

Cedi dropped about ¢3.15 to the US dollar so far in 2022.

The Ghana cedi has suffered some 32% drop from the USD.

The drop in the Ghanaian cedi against the USD is equivalent to about a 32% loss since the cedi was redenominated in 2007, a Joy Business report stated. The local currency ended in 2021 with a rate of ¢6.49 to one US dollar and in 2016 with a rate of ¢4.33 to one American greenback’.

So far this year, the cedi has come under severe pressure as some foreign holders of Ghana’s Eurobonds have been selling off their stakes, largely because of the perceived negative outlook of the Ghanaian economy.

Together with other factors, they have caused the high demand for the dollar, which is presently going for ¢9.70 on the retail market or forex bureaus. This followed recent downgrades of the country’s credit rating by rating agencies, Fitch, Moody’s, and S&P.

The significant loss in the value of the cedi means businesses that depend on imports for production may have to spend more to run their operations.

Similarly, the cost of capital of most firms has declined, thus worsening their state of operations. BoG assures of cedi stability However, the Bank of Ghana has given assurance that the cedi’s stability will be restored soon, based on certain measures that are being put in place.

They include cooperation agreements with the mining companies to provide the Central Bank with the opportunity to buy gold as and when it becomes available and foreign currency liquidity support to the banking sector to help meet the demand for external payments and the intended economic program for the country will have with the International Monetary Fund.

Meanwhile, the $750 million commercial loan approved by Parliament last month is expected to hit the account of the Bank of Ghana latest this Thursday, August 18th, 2022. This is expected to help offset the demand for dollars in recent days.

Story by Joy Business

Prosper Kwaku Selassy Agbitor

Prosper Kwaku Selassy Agbitor